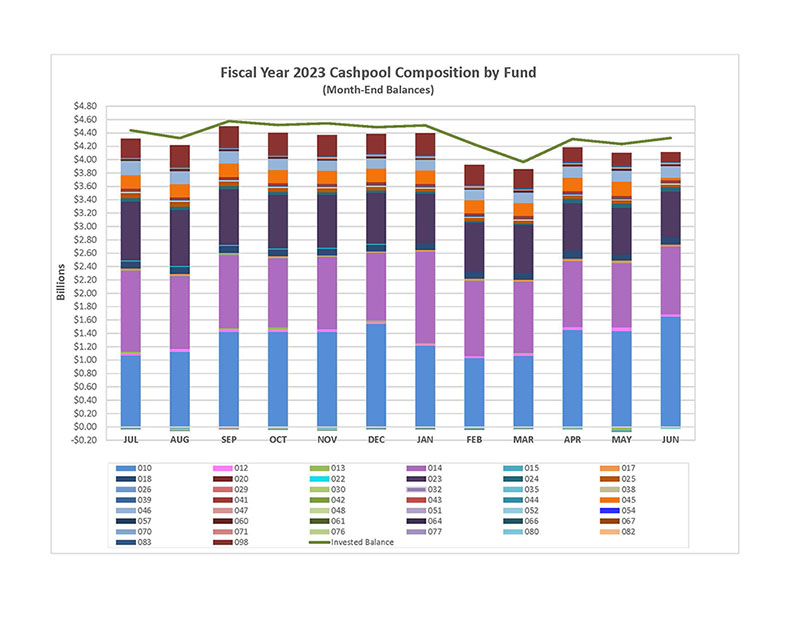

The State of Maine cash Pool represents investments permissible by Maine Statute: Title 5: Administrative Procedures and Services, Part 1: State Departments, Chapter 7: Treasurer of State, Section 135, and consists of excess money in the State Treasury that is 'not needed to meet current obligations'. The State funds and funds of component units of the State are pooled and invested by the Treasurer's Office; generally most securities are held to maturity or called when the par value of the security is received.

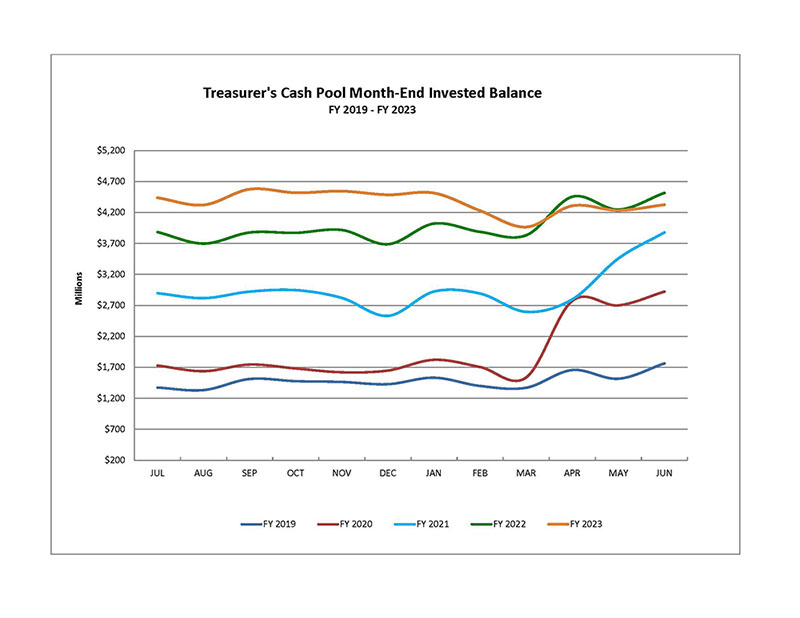

Permitted investments and their desired composition, terms and credit quality are further defined by the Maine State Treasurer's Investment Policy. As of June 30, 2023, the cost of purchased investments in the Treasurer's Cash Pool was $4.32 billion with a weighted average effective maturity of 242 days.

Distribution of Earnings

The investment pool recognizes income on an amortized cost basis throughout the year, which produces a more level stream of income over the life of an investment. Monthly reports detailing investment holdings and income are prepared internally by the Treasurer's Office, by Wells Fargo, our trade custodian, and by our investment advisory firm, PFM. These reports are used to prepare a monthly accrual journal to record income earned but not yet matured.

Received and earned income is distributed to each participant the month after the income is earned and is prorated based on the average daily cash balance of participating funds. For example, July earnings are distributed in August based on average July cash balances. Investment income includes: interest earned, accretion of discounts, amortization of premiums on a constant yield method, and any gain or loss on securities that are called or sold prior to maturity.

State Agencies must notify the Treasurer's Office when legislation dictates that earnings are to be credited back to the respective funds; otherwise, fund earnings without a statutory mandate are distributed to the General Fund. Interest credited back to funds is calculated as follows:

Average Daily Balance of an Account X Cash Pool Rate X (# of Days in Month/365 days)

The monthly Cash Pool rate is derived by:

Total Investment Earnings for the Month (Net of fees)/# of days in a month X 365 days/PFM Average Historical Cost

The Treasurer's Office normally calculates the Cash Pool Distribution during the 3rd or 4th week of the month, prepares the entries to the accounting system to distribute the earnings, and notifies participants by memo as requested. Should a participant's calculated average daily balance for a month be negative, the participant shall be charged for the use of other participants' funds in the prorated distribution as outlined by an amendment to MRSA Section 131-B, by Chapter 386, Part CC, passed in June 2005, and further defined by the Treasurer's Short-Term General Fund Borrowing and Transfer Guidelines.